#Smart Invoice Accounting Software

Explore tagged Tumblr posts

Text

Have You Heard? Smart Invoice Accounting Software Is Your Best Bet for Growth

In today’s fast-paced digital world, technology empowers businesses, both small ones to operate more efficiently. Whether you're selling or buying, tech tools are transforming every aspect of business management. Accounting, the backbone of any business’s financial health, is no exception. With complex operations and evolving tax regulations, traditional methods don’t cut it anymore.

Enter smart accounting software, a game-changer for modern businesses. Say goodbye to paperwork overload and tax-time stress. ZRA accounting software is revolutionizing how businesses handle invoicing and tax management, making it simpler, faster, and more accurate.

Are you struggling to manage and file tax returns on time?

For many MSMES, juggling invoices, payments, and tax compliance can be overwhelming. Manual ZRA tax filing increases the risk of costly errors, penalties, and lost time.

Manage your business anytime, anywhere. With quick invoicing, seamless payment tracking, and precise tax filing, accounting software helps you reduce errors, stay compliant, and drive growth with ease.

ZRA Compliance in the Modern Business Landscape:

In today’s dynamic business environment, staying compliant with ZRA regulations can be challenging. Frequent updates to tax laws, intricate filing procedures, and the high risk of human error make manual tax management both time-consuming and stressful.

That’s where ZRA accounting software steps in as a reliable partner. By simplifying financial calculations and simplifying the filing process, it removes the guesswork from compliance. The software ensures your business stays up-to-date with the latest tax regulations, accurately and effortlessly.

Streamline Your Billing and Boost Productivity with Smart Invoice Software

Enhanced Efficiency:

Manual invoicing can be tedious and error-prone. With Smart Invoice Software in Zambia, businesses can automate the entire billing process—from invoice creation and delivery to payment tracking and overdue account management. Built-in features like customizable invoice templates and integrated payment gateways help eliminate manual tasks, saving valuable time and improving overall workflow. This automation not only enhances efficiency but also ensures a seamless and professional customer experience.

Track Income & Expenses Seamlessly

Modern accounting tools consolidate your financial data in one secure platform, offering real-time visibility into your income and expenses. These systems do more than just record numbers—they allow you to generate profit and loss reports, create income statements, and calculate interest quickly and accurately, all while reducing the risk of human error.

Comprehensive Financial Reporting

With just a few clicks, users can generate detailed financial reports that provide deep insights into business performance. These reports highlight key performance indicators (KPIS), enabling better financial assessment. Built-in analytics help identify trends over time, empowering proactive and strategic decision-making.

Centralized Data Management

Business operations software allows you to centralize data across departments, providing a unified view of your operations. This centralization improves data accessibility, enhances analysis, and supports smarter, faster business decisions.

Cloud-Based Access Anytime, Anywhere

Cloud-based accounting software offers mobility and flexibility by allowing access from any location, at any time. This not only improves productivity but also supports remote work and real-time collaboration across teams, ensuring that critical financial tasks are never delayed.

Fast Invoicing and Real-Time Status Tracking

Modern accounting systems streamline the invoicing process by automating calculations, sending invoices, and tracking payment statuses. Many tools can even trigger automatic payment reminders, helping reduce late payments and minimize follow-ups. Secure payment portals further enhance the customer experience by offering convenient and trusted transaction options.

Enhanced User Experience

A user-friendly accounting interface reduces complexity and improves workflow. When employees can navigate the system efficiently, it reduces stress, boosts productivity, and enhances team satisfaction. A smooth user experience is essential to ensure that staff can focus on meaningful tasks rather than battling with outdated systems.

Built for Growth-Focused Businesses

Modern business accounting software is a powerful tool for growing enterprises. It simplifies financial management by automating invoicing, tracking expenses, and generating accurate reports. Streamlining complex accounting tasks saves time, minimizes errors, and empowers business owners to make informed decisions, allowing them to focus on scaling operations and driving growth.

Minimize Human Errors

Unlike manual processes prone to mistakes, accounting software performs calculations with speed and precision. By reducing the need for manual data entry, businesses can improve data accuracy, ensure compliance, and maintain reliable financial records with confidence.

Seamless Bookkeeping & Accounts Production

Integrated accounting platforms combine bookkeeping and accounts production in one streamlined system. Automated data synchronization eliminates repetitive entry, improves accuracy, and accelerates the preparation of financial statements. This efficiency allows accountants to shift focus from administrative tasks to strategic insights and advisory services.

Accelerated Response Time

In today’s fast-moving business environment, speed is essential. Online accounting software enhances internal efficiency, improves workforce productivity, and enables businesses to act quickly and decisively. The result? You can accomplish more in less time, keeping your business agile and competitive.

Conclusion

In a competitive and fast-evolving business landscape, smart accounting software, Smart Invoice is no longer a luxury, it’s a necessity. From smart invoicing and simplifying ZRA tax compliance to streamlining expense tracking and delivering real-time financial insights, this technology empowers MSMEs to grow with confidence.

By reducing manual errors, improving operational efficiency, and enabling faster decision-making, smart invoice accounting software helps business owners reclaim valuable time and focus on what truly matters, scaling their business. Whether you're managing a startup or an expanding enterprise, adopting cloud-based, user-friendly, and intelligent financial tools can unlock new levels of productivity and performance.

Embrace the future of accounting. Let Smart Invoice Software simplify your finances and fuel your business growth anytime, anywhere.

0 notes

Text

Have You Heard? Smart Invoice Accounting Software Is Your Best Bet for Growth

In today’s fast-paced digital world, technology empowers businesses, both small ones to operate more efficiently. Whether you're selling or buying, tech tools are transforming every aspect of business management. Accounting, the backbone of any business’s financial health, is no exception. With complex operations and evolving tax regulations, traditional methods don’t cut it anymore.

Enter smart accounting software, a game-changer for modern businesses. Say goodbye to paperwork overload and tax-time stress. ZRA accounting software is revolutionizing how businesses handle invoicing and tax management, making it simpler, faster, and more accurate.

Are you struggling to manage and file tax returns on time?

For many MSMES, juggling invoices, payments, and tax compliance can be overwhelming. Manual ZRA tax filing increases the risk of costly errors, penalties, and lost time.

Manage your business anytime, anywhere. With quick invoicing, seamless payment tracking, and precise tax filing, accounting software helps you reduce errors, stay compliant, and drive growth with ease.

ZRA Compliance in the Modern Business Landscape:

In today’s dynamic business environment, staying compliant with ZRA regulations can be challenging. Frequent updates to tax laws, intricate filing procedures, and the high risk of human error make manual tax management both time-consuming and stressful.

That’s where ZRA accounting software steps in as a reliable partner. By simplifying financial calculations and simplifying the filing process, it removes the guesswork from compliance. The software ensures your business stays up-to-date with the latest tax regulations, accurately and effortlessly.

Streamline Your Billing and Boost Productivity with Smart Invoice Software

Enhanced Efficiency:

Manual invoicing can be tedious and error-prone. With Smart Invoice Software in Zambia, businesses can automate the entire billing process—from invoice creation and delivery to payment tracking and overdue account management. Built-in features like customizable invoice templates and integrated payment gateways help eliminate manual tasks, saving valuable time and improving overall workflow. This automation not only enhances efficiency but also ensures a seamless and professional customer experience.

Track Income & Expenses Seamlessly

Modern accounting tools consolidate your financial data in one secure platform, offering real-time visibility into your income and expenses. These systems do more than just record numbers—they allow you to generate profit and loss reports, create income statements, and calculate interest quickly and accurately, all while reducing the risk of human error.

Comprehensive Financial Reporting

With just a few clicks, users can generate detailed financial reports that provide deep insights into business performance. These reports highlight key performance indicators (KPIS), enabling better financial assessment. Built-in analytics help identify trends over time, empowering proactive and strategic decision-making.

Centralized Data Management

Business operations software allows you to centralize data across departments, providing a unified view of your operations. This centralization improves data accessibility, enhances analysis, and supports smarter, faster business decisions.

Cloud-Based Access Anytime, Anywhere

Cloud-based accounting software offers mobility and flexibility by allowing access from any location, at any time. This not only improves productivity but also supports remote work and real-time collaboration across teams, ensuring that critical financial tasks are never delayed.

Fast Invoicing and Real-Time Status Tracking

Modern accounting systems streamline the invoicing process by automating calculations, sending invoices, and tracking payment statuses. Many tools can even trigger automatic payment reminders, helping reduce late payments and minimize follow-ups. Secure payment portals further enhance the customer experience by offering convenient and trusted transaction options.

Enhanced User Experience

A user-friendly accounting interface reduces complexity and improves workflow. When employees can navigate the system efficiently, it reduces stress, boosts productivity, and enhances team satisfaction. A smooth user experience is essential to ensure that staff can focus on meaningful tasks rather than battling with outdated systems.

Built for Growth-Focused Businesses

Modern business accounting software is a powerful tool for growing enterprises. It simplifies financial management by automating invoicing, tracking expenses, and generating accurate reports. Streamlining complex accounting tasks saves time, minimizes errors, and empowers business owners to make informed decisions, allowing them to focus on scaling operations and driving growth.

Minimize Human Errors

Unlike manual processes prone to mistakes, accounting software performs calculations with speed and precision. By reducing the need for manual data entry, businesses can improve data accuracy, ensure compliance, and maintain reliable financial records with confidence.

Seamless Bookkeeping & Accounts Production

Integrated accounting platforms combine bookkeeping and accounts production in one streamlined system. Automated data synchronization eliminates repetitive entry, improves accuracy, and accelerates the preparation of financial statements. This efficiency allows accountants to shift focus from administrative tasks to strategic insights and advisory services.

Accelerated Response Time

In today’s fast-moving business environment, speed is essential. Online accounting software enhances internal efficiency, improves workforce productivity, and enables businesses to act quickly and decisively. The result? You can accomplish more in less time, keeping your business agile and competitive.

Conclusion

In a competitive and fast-evolving business landscape, smart accounting software, Smart Invoice is no longer a luxury, it’s a necessity. From smart invoicing and simplifying ZRA tax compliance to streamlining expense tracking and delivering real-time financial insights, this technology empowers MSMEs to grow with confidence.

By reducing manual errors, improving operational efficiency, and enabling faster decision-making, smart invoice accounting software helps business owners reclaim valuable time and focus on what truly matters, scaling their business. Whether you're managing a startup or an expanding enterprise, adopting cloud-based, user-friendly, and intelligent financial tools can unlock new levels of productivity and performance.

Embrace the future of accounting. Let Smart Invoice Software simplify your finances and fuel your business growth anytime, anywhere.

0 notes

Text

🧾 GST Billing & Invoicing Software – The Ultimate Solution for Small Businesses in India

In today’s fast-paced business world, managing GST invoices, stock, and accounts manually is not only time-consuming but prone to errors. This is where a smart GST Billing & Invoicing Software comes to your rescue.

Whether you run an optical store, retail shop, or small business — using automated GST software can save hours and boost productivity.

✅ Why You Need GST Billing Software

1. 100% GST Compliant Invoices - Create professional invoices with your GSTIN, HSN/SAC codes, and automated tax calculations — in seconds.

2. E-Invoice Generation - Connect directly with the GSTN portal for seamless e-invoicing and avoid penalties.

3. Integrated Stock & Inventory Management - Track your real-time stock levels, product batches, expiry dates, and low stock alerts — all from your billing screen.

4. Sales, Purchase, & Return Management - Handle sales orders, purchase orders, quotations, and returns with one-click conversion to invoices.

5. Tally Integration & Accounting - Export reports directly to Tally ERP and simplify your accounting process.

🔍 Top Features of GST Billing & Invoicing Software

📦 Inventory & Stock Control

💳 POS System for Fast Billing

🧾 GST Reports: GSTR-1, GSTR-3B, GSTR-9

📈 100+ Business Reports (Profit & Loss, Stock, Sales)

🧑💼 Multi-user Access with Role Permissions

☁️ Cloud Backup & Data Security

📱 Mobile & Desktop Compatible

👨💻 Who Is It For?

This software is ideal for:

🕶️ Optical Shops

🛍️ Retail Stores

🏥 Pharmacies

🧰 Hardware Shops

📚 Book Stores

🏬 Small & Medium Enterprises (SMEs)

🚀 Boost Business Efficiency Today!

Switching to a Partum GST billing software is not just about compliance — it’s about scaling your business smartly. With built-in automation, detailed reports, and error-free invoicing, your daily operations become faster and smoother.

📞 Book your FREE demo now! ✅ No credit card needed ✅ 17+ Software packages ✅ Trusted by 5,000+ businesses

youtube

#gst billing software#InvoicingSoftwareIndia#BillingAndInventory#RetailBilling#EInvoiceIndia#TallyIntegration#Youtube

2 notes

·

View notes

Text

Navigate the New Rules of ZATCA e-Invoicing Phase 2

The digital shift in Saudi Arabia’s tax landscape is picking up speed. At the center of it all is ZATCA e-Invoicing Phase 2—a mandatory evolution for VAT-registered businesses that brings more structure, security, and real-time integration to how invoices are issued and reported.

If you’ve already adjusted to Phase 1, you’re halfway there. But Phase 2 introduces new technical and operational changes that require deeper preparation. The good news? With the right understanding, this shift can actually help streamline your business and improve your reporting accuracy.

Let’s walk through everything you need to know—clearly, simply, and without the technical overwhelm.

What Is ZATCA e-Invoicing Phase 2?

To recap, ZATCA stands for the Zakat, Tax and Customs Authority in Saudi Arabia. It oversees tax compliance in the Kingdom and is driving the movement toward electronic invoicing through a phased approach.

The Two Phases at a Glance:

Phase 1 (Generation Phase): Started in December 2021, requiring businesses to issue digital (structured XML) invoices using compliant systems.

Phase 2 (Integration Phase): Began in January 2023, and requires companies to integrate their invoicing systems directly with ZATCA for invoice clearance or reporting.

This second phase is a big leap toward real-time transparency and anti-fraud efforts, aligning with Vision 2030’s goal of building a smart, digital economy.

Why Does Phase 2 Matter?

ZATCA isn’t just ticking boxes—it’s building a national infrastructure where tax-related transactions are instant, auditable, and harder to manipulate. For businesses, this means more accountability but also potential benefits.

Benefits include:

Reduced manual work and paperwork

More accurate tax reporting

Easier audits and compliance checks

Stronger business credibility

Less risk of invoice rejection or disputes

Who Must Comply (and When)?

ZATCA isn’t pushing everyone into Phase 2 overnight. Instead, it’s rolling out compliance in waves, based on annual revenue.

Here's how it’s working:

Wave 1: Companies earning over SAR 3 billion (Started Jan 1, 2023)

Wave 2: Businesses making over SAR 500 million (Started July 1, 2023)

Future Waves: Will gradually include businesses with lower revenue thresholds

If you haven’t been notified yet, don’t relax too much. ZATCA gives companies a 6-month window to prepare after they're selected—so it’s best to be ready early.

What Does Compliance Look Like?

So, what exactly do you need to change in Phase 2? It's more than just creating digital invoices—now your system must be capable of live interaction with ZATCA’s platform, FATOORA.

Main Requirements:

System Integration: Your invoicing software must connect to ZATCA’s API.

XML Format: Invoices must follow a specific structured format.

Digital Signatures: Mandatory to prove invoice authenticity.

UUID and Cryptographic Stamps: Each invoice must have a unique identifier and be digitally stamped.

QR Codes: Required especially for B2C invoices.

Invoice Clearance or Reporting:

B2B invoices (Standard): Must be cleared in real time before being sent to the buyer.

B2C invoices (Simplified): Must be reported within 24 hours after being issued.

How to Prepare for ZATCA e-Invoicing Phase 2

Don’t wait for a formal notification to get started. The earlier you prepare, the smoother the transition will be.

1. Assess Your Current Invoicing System

Ask yourself:

Can my system issue XML invoices?

Is it capable of integrating with external APIs?

Does it support digital stamping and signing?

If not, it’s time to either upgrade your system or migrate to a ZATCA-certified solution.

2. Choose the Right E-Invoicing Partner

Many local and international providers now offer ZATCA-compliant invoicing tools. Look for:

Local support and Arabic language interface

Experience with previous Phase 2 implementations

Ongoing updates to stay compliant with future changes

3. Test in ZATCA’s Sandbox

Before going live, ZATCA provides a sandbox environment for testing your setup. Use this opportunity to:

Validate invoice formats

Test real-time API responses

Simulate your daily invoicing process

4. Train Your Staff

Ensure everyone involved understands what’s changing. This includes:

Accountants and finance officers

Sales and billing teams

IT and software teams

Create a simple internal workflow that covers:

Who issues the invoice

How it gets cleared or reported

What happens if it’s rejected

Common Mistakes to Avoid

Transitioning to ZATCA e-Invoicing Phase 2 isn’t difficult—but there are a few traps businesses often fall into:

Waiting too long: 6 months isn’t much time if system changes are required.

Relying on outdated software: Non-compliant systems can cause major delays.

Ignoring sandbox testing: It’s your safety net—use it.

Overcomplicating the process: Keep workflows simple and efficient.

What Happens If You Don’t Comply?

ZATCA has teeth. If you’re selected for Phase 2 and fail to comply by the deadline, you may face:

Financial penalties

Suspension of invoicing ability

Legal consequences

Reputation damage with clients and partners

This is not a soft suggestion—it’s a mandatory requirement with real implications.

The Upside of Compliance

Yes, it’s mandatory. Yes, it takes some effort. But it’s not all downside. Many businesses that have adopted Phase 2 early are already seeing internal benefits:

Faster approvals and reduced invoice disputes

Cleaner, more accurate records

Improved VAT recovery processes

Enhanced data visibility for forecasting and planning

The more digital your systems, the better equipped you are for long-term growth in Saudi Arabia's evolving business landscape.

Final Words: Don’t Just Comply—Adapt and Thrive

ZATCA e-invoicing phase 2 isn’t just about avoiding penalties—it’s about future-proofing your business. The better your systems are today, the easier it will be to scale, compete, and thrive in a digital-first economy.

Start early. Get the right tools. Educate your team. And treat this not as a burden—but as a stepping stone toward smarter operations and greater compliance confidence.

Key Takeaways:

Phase 2 is live and being rolled out in waves—check if your business qualifies.

It requires full system integration with ZATCA via APIs.

Real-time clearance and structured XML formats are now essential.

Early preparation and testing are the best ways to avoid stress and penalties.

The right software partner can make all the difference.

2 notes

·

View notes

Text

Reasons Why It's Important to Keep Accurate Business Records💯📝

In today's fast-paced business world, keeping accurate and organised records is the key to success and growth! 🏢💼 That's why bookkeeping services are a game-changer! Continue on reading to find out what advances proper record keeping has and get helpful recommendations on reliable bookkeeping services Sunshine Coast. Let's dive into the amazing benefits they bring: 1️⃣ Managing Cash Flow: 💰 Maintaining a healthy cash flow is crucial for your business's sustainability. With professional bookkeeping services, you can track cash inflow and outflow, identify potential shortages, and proactively manage your finances. No more surprises, just financial stability even in unforeseen circumstances! 🌈🚀 2️⃣ Providing Valuable Financial Insights: 📈 Accurate records through bookkeeping services give you priceless insights into your company's financial situation. You can analyse spending patterns, pinpoint areas for cost reduction, and gain a comprehensive understanding of your business's financial health. Armed with this knowledge, you'll make informed decisions and boost your company's performance! 💡💪 3️⃣ Making Informed Financial Decisions: 💸 Understanding your business's finances is the key to making smart choices. Bookkeeping services ensure you have up-to-date information about revenues, expenses, and overall financial position. With this knowledge, you can evaluate investment opportunities, assess project profitability, and strategically plan for your company's future growth! 📊💼 4️⃣ Avoiding Tax Penalties: ⚖️ Nobody wants to deal with hefty penalties and financial burdens! Accurate record-keeping through bookkeeping services saves you from that headache. You'll have the necessary documentation to support your tax declarations, income statements, and deductions. By working with professional accounting consultants like Wardle Partners Accountants and Advisors on the Sunshine Coast, you stay compliant with tax laws, submit accurate reports, and minimise risks. A win-win situation! 💯📝 5️⃣ Reducing Stress During Tax Time: 😅📅 Tax season can be stressful, but with proper record keeping, you can breeze through it! Bookkeeping services help you stay organised throughout the year. All of your financial records, including receipts and invoices, will be easily accessible, facilitating a quick and easy filing procedure. With cloud software, you can save time by electronically collecting records and attaching them to your accounting software. Say goodbye to last-minute scrambling for missing information! 🌤️⏰ Remember, accurate business records are the backbone of your success! Take charge of your financial records and seek professional help if needed. If you're in need of accounting, tax preparation, or bookkeeping services on the Sunshine Coast, Wardle Partners Accountants and Advisors have got you covered! 🤝🌟 Our experienced professionals offer personalised and efficient services tailored to your unique needs.🚀💼 #BookkeepingServices #SunshineCoast #FinancialSuccess #AccurateRecords #BusinessGrowth #StressFreeTaxSeason

2 notes

·

View notes

Text

🚀 Supercharge Your Finances with Olivo Business: The Best Accounting Software in Saudi Arabia.

In today’s digital-first world, efficiency isn't just an advantage—it’s essential. Olivo Business stands out as one of the most trusted names among cloud accounting software in Saudi Arabia, helping businesses streamline operations with ease and sophistication.

☁️ Embrace the Cloud—Stay in Control Anywhere

Whether you're in Riyadh, Jeddah, or Dammam, Olivo Business ensures you stay connected to your business. Access your financials, manage invoices, and collaborate with your team—anytime, anywhere. Say goodbye to being desk-bound and hello to real-time control and flexibility.

💼 Invoicing That Speaks Professionalism

No more dull, generic invoices. With Olivo Business, create stunning, customized invoices that reflect the strength of your brand. It's not just invoicing—it's marketing in disguise, enhancing your client relationships effortlessly.

🧠 Smart Tools for Smart Teams

From automated time tracking to detailed reporting, Olivo Business empowers small and medium-sized businesses with tools usually reserved for enterprise giants. And the interface? Designed for everyone—from seasoned accountants to first-time entrepreneurs.

🔄 Automation = Liberation

Routine tasks are no longer your burden. Automate everything from billing to tax calculations. Let Olivo handle the complexities while you focus on growing your business. This is where efficiency meets peace of mind.

📊 Advanced Financial Modules

Enjoy robust modules like:

Finance (trial balance, income statements, budgeting, multi-currency)

Sales (invoices, profit analysis, customer statements)

Purchases (RFQs, vendor payments, multi-currency support)

Inventory (stock movement, multi-location tracking, real-time updates)

Built for businesses across Riyadh, Jeddah, Dammam, and beyond, Olivo Business delivers the best accounting software in Saudi Arabia with top-tier precision.

🤝 Cultivate Customer Loyalty

Manage the sales journey from inquiry to payment, delivering personalized experiences. Build trust, simplify communication, and maintain lasting customer relationships—all under one platform.

Ready to transform your finances with simplicity and style?

🔗 Explore more: https://olivotech.com/accounting-software

#BusinessGrowth#softwareRiyadh#accountingSoftwareRiyadh#cloudAccountingSoftwareSaudiArabia#bestAccountingSoftwareInSaudiArabia#accountingSoftwareJeddah#accountingSoftwareDammam#OlivoBusiness#FinancialSuccess#SmartAccounting

0 notes

Text

Top Tips for Choosing the Best Business Bank Account

Running a business, especially in the fast-paced digital world, requires more than just great products or services—it demands smart financial management. One of the most critical decisions entrepreneurs face is choosing the right business bank account. Whether you’re a startup founder or managing a growing enterprise, the right bank account can simplify operations, support your cash flow, and even reduce costs.

This is particularly true for companies in dynamic sectors like travel, where efficient tools like travel booking software and travel management software work best when integrated with a responsive and feature-rich business bank account. Here are some top tips to help you choose wisely:

1. Understand Your Business Needs

Start by evaluating your financial habits. Do you make frequent international transactions? Do you need integration with payroll and invoicing systems? For businesses in the travel industry, having a bank account that syncs smoothly with travel booking software is a major advantage.

2. Look for Low or No Fees

Monthly maintenance charges, transaction fees, and ATM fees can quickly eat into your profits. Opt for accounts that offer transparent pricing or waive fees when certain conditions are met. Small and medium-sized businesses often benefit from accounts with minimal overhead.

3. Check for Integration with Financial Tools

Today’s business accounts should do more than hold money. Look for options that offer seamless integration with travel management software, accounting tools, and expense tracking platforms. Automation can save hours in reconciliation and help avoid human error.

4. Prioritize Online and Mobile Banking

In an era of remote work and global travel, mobile access is non-negotiable. Ensure the bank offers a user-friendly app with essential features like fund transfers, real-time balance updates, and multi-user access for your finance team.

5. Consider International Transaction Capabilities

If your business books travel services across borders, or works with overseas partners, prioritize accounts that offer competitive foreign exchange rates and low international wire fees. Integration with travel booking software makes these international transactions even more streamlined.

6. Explore Value-Added Services

Some banks offer perks like invoicing tools, expense management solutions, and access to credit. These extras are especially helpful when used alongside travel management software, which can centralize your business travel spending and vendor payments.

7. Ensure Excellent Customer Support

A responsive support team is invaluable—especially when you're managing travel bookings or dealing with urgent payment issues. Look for banks with 24/7 helplines, chat support, or a dedicated relationship manager.

8. Evaluate Account Security

Security is critical for any business. Choose a bank that offers two-factor authentication, fraud detection, and regular transaction alerts. This is particularly vital when integrating your bank account with digital tools like travel booking software.

9. Compare Interest Rates and Overdraft Facilities

If you maintain a healthy balance, an account with competitive interest rates can offer added value. On the other hand, access to business overdrafts can help during cash crunches—essential for industries with fluctuating revenues, like travel.

10. Read the Fine Print

Always review the terms and conditions. Watch for hidden fees, minimum balance requirements, and transaction limits. The right business bank account should offer flexibility as your company evolves.

Final Thoughts

Whether you're a travel agency using travel management software or a startup scaling globally, the right business bank account can empower your operations. It should do more than store money—it should act as a tool for growth, automation, and financial clarity.

0 notes

Text

Ecuenta Financial Accounting Software

Ecuenta is your ultimate solution for smart invoicing and effortless ZRA tax compliance. Designed to streamline financial management, it empowers businesses with accurate, efficient, and reliable tools to handle invoicing, budgeting, and tax obligations seamlessly. Simplify your accounting processes.

#accounting ERP#accounting software#accounting software in zambia#financial accounting software#smart invoice accounting software

0 notes

Text

Ecuenta Financial Accounting Software

Ecuenta is your ultimate solution for smart invoicing and effortless ZRA tax compliance. Designed to streamline financial management, it empowers businesses with accurate, efficient, and reliable tools to handle invoicing, budgeting, and tax obligations seamlessly. Simplify your accounting processes.

#accounting ERP#accounting software#accounting software in zambia#financial accounting software#smart invoice accounting software

0 notes

Text

How to Prepare Your Business Books for Year-End

As the year comes close, the time has come to bring the finance of your business in order. Whether you are the masters of a small business, freelancer, or a limited company, it is necessary to prepare your books for the end of the year. This helps you complete the tax time limit, avoid punishment and understand how your business has performed in the year.

In this blog, we will walk to you through a clear and simple way to prepare your business books for the end of the year. With the right steps, you can save time, reduce stress, and handle a better handle on your finance.

1. Gather all your financial records

The first step is to collect all your financial documents. It also includes:

• sales invoice

• Expenditure receipts

• Bank details

• Credit Card Statement

• loan documents

• payroll record

• VAT returns (if registered)

Make sure everything is complete and organized. If you are using accounting software such as Xero or Quickbooks, double-check that all your transactions are recorded correctly.

2. Cover your bank accounts

Bank harmony means that transactions in your accounting system match your bank statement. This helps to ensure that there are no missing or duplicate entries.

To cover your accounts:

• Match every payment and deposit

• Fix any error or difference

• Ensure that all bank fees or interests have been recorded

This step is important because it reflects the correct cash status of your business.

3. Review income and expenses

Go through your income and expenditure accounts to check for accuracy. ask yourself:

• Has all sales recorded?

• Are there any missing receipts?

• Are personal expenses mixed with business people? Make sure all expenses are classified correctly (e.g., office supplies, travel, marketing). This will help you claim all the tax deductions you’re entitled to.

4. Check for outstanding challans and bills

See your accounts attainable (what customers are outstanding) and account payable (what you want to give to suppliers). Follow any unpaid invoice and make sure you pay any outstanding bill before the year ends.

If you have challans that are unlikely to pay, you may need to write them as a bad loan — speak with your accountant about it.

5. Count your inventory (if applied)

If your business sells physical product, you will need to count an inventory. Compare your actual stock what is recorded in your system and pay attention to any difference.

It helps:

• Update your cost of goods sold (COGS)

• Identify slow running or old stock

• Prepare more accurately for future orders

6. Review real estate and depreciation

Fixed assets are items such as computers, vehicles, or office furniture that own your business. Check your records to ensure this:

• All assets are listed

• Settled or sold property is removed

• Depreciation is properly recorded

Your accountant can help calculate depreciation, which reduces your taxable income.

7. Back up your financial data

It is always smart to keep backup of your accounting data. If you are using a cloud accounting software, this can happen automatically. If not, make a safe backup you have:

• Accounting files

• spreadsheet

• receipts and documents

Store them on external drive or safe cloud service.

8. Prepare for your accountant or HMRC

Now that your books are in order, make sure that you have everything ready to send your accountant or HMRC. This can include:

Year-end trial balance

Profit and loss report

Balance sheet

VAT and payroll records

Having everything organised will help your accountant file your tax returns faster — and may even reduce their fees.

9. Review and reflect

Year-end is a great time to reflect your commercial performance. ask yourself:

• Do you meet your financial goals?

• What were your biggest expenses?

• Can you cut cost next year?

• Which development opportunities can you detect?

Use your year end report to make better planning for the coming year.

final thoughts

Preparing your business books for the end of the year can be a big task, but it is not stressful. With a little plan and correct equipment, you can close the year smoothly and get ready for the new.

If you need help with bookkeeping, payroll, VAT, or end accounts of the year, then stewart accounting is to support you here. We work with small businesses, contractors, landlords and more — provide clear advice and expert services to help your business grow.

Are you ready to make the end of the year easier? Contact stewart accounting today for

1 note

·

View note

Text

Best 5 Accounts Payable Automation Software Tools in 2025

With numerous alternatives available, selecting the best accounts payable automation software can be challenging. So, how can you determine which one is best for you? With hundreds of suppliers fighting for your business, each offering its own set of services and pricing methods, it's hard to know where to begin.

Instead of spending hours comparing options and delving through technical minutiae, you have a handy guide that handles all of the work for you. We examined the top accounts payable automation software products, considering factors such as user interfaces, security, integration, and pricing.

Whether you're a small business searching for a basic solution or a huge corporation in need of strong features, we'll teach you how to select the best system to optimize your AP procedures and keep your cash flow flowing.

Download the sample report of Market Share: https://qksgroup.com/download-sample-form/market-forecast-accounts-payable-automation-2022-2027-worldwide-2204

What is Accounts Payable Automation?

According to QKS Group, an Accounts Payable (AP) application refers to a software solution that enables organizations to automate, manage, and monitor financial transactions owed to vendors. This includes invoice entry, payment processing, and reporting capabilities. By automating the AP processes, organizations can match invoices with Purchase Orders (PO) for executing part or full payments, while effectively managing and reconciling vendors. The use of AP applications helps streamline the entire accounts payable process, eliminating manual tasks, and providing better visibility and control over crucial financial data.

Top Features of Accounts Payable Automation Software

An AP automation solution eliminates manual processes by automating the accounts payable payment process to speed up day-to-day AP processes.

Accounts payable automation software includes:

OCR invoice scanning for data capture

Accounts payable invoice processing software

Automated approvals

Global cross-border payments

Accounts payable document management software

Our accounts payable automation software provides self-service supplier onboarding, tax compliance, fraud prevention, payment discount optimization, electronic document matching, online multi-currency global mass payments, secure payment methods, automatic payment reconciliation, and spend and cash management.

AP automation software streamlines payable operations, reducing human data entry and paper check payments.

Top Accounts Payable Automation Software

AvidXchange

AvidXchange specializes in providing accounts payable automation software and payment resolutions. Primarily, it serves the needs of middle-market enterprises and their suppliers. The firm places a strong focus on innovation, which is evident in the services it provides. The firm maintains an innate culture of entrepreneurship, spurring innovation. Its main goal is to expand, network, and make a lasting contribution to the industry it serves.

Basware

Basware enables finance professionals in multinational businesses to finally automate their complicated, labor-intensive invoice processes while remaining compliant with regulatory changes. Basware's AP automation and invoicing platform helps companies achieve a new level of efficiency – in a matter of months – while reducing errors and risks.

Bill.com

Bill (formerly Bill.com) is a U.S.-based firm offering accounting automation solutions, including accounts payable, receivable, and cost management. Bill is a smart solution that enables you to create and pay invoices, track employee expenses, streamline approvals, and transfer payments, all from one platform. It also integrates seamlessly with various accounting systems, allowing customers to store invoices on a cloud-based platform while ensuring compliance and being audit-ready.

Coupa

Coupa Software is a cloud-based software dedicated to business spend management (BSM). Coupa Software aims to help businesses gain insight and control over their spending, leading to more productive and secure decisions. The company has a global outreach and serves an extensive range of businesses worldwide.

Tipalti

Tipalti provides solutions for accounts payable, procurement, and bulk payments. Tipalti plans to speed up book closure by 25% by simplifying vendor onboarding, invoice processing, global payables, and tax compliance.

Tipalti connects smoothly with NetSuite ERP. It also provides consumers with clear visibility into their expenditures and gathers critical information from vendor documentation. Tipalti, well known for its worldwide partner payments, is chosen by businesses that handle a high number of cross-border payments.

Download the sample report of Market Forecast: https://qksgroup.com/download-sample-form/market-share-accounts-payable-automation-2022-worldwide-2400

Choosing the Right Accounts Payable Automation Software

Implementing accounts payable software can only help your procurement process if you carefully select a solution that offers flexibility, visibility, and security without sacrificing functionality.

Consider software that makes it simple to clear payments but does not settle them for days on the vendor's end. Consider an alternative that your legal or IT staff is reluctant to implement. A QKS Group is a global advisory and consulting firm, offers valuable insights into the account payable automation market. Their Market Intelligence reports, such as " Accounts Payable Automation Market Share, 2023, Worldwide," and "Market Forecast: Accounts Payable Automation, 2024-2028, Worldwide," provide comprehensive data on market trends, competitive landscapes, and growth forecasts. Such reports are indispensable for industry professionals, decision-makers, and stakeholders seeking in-depth knowledge about the AP automation market and multiple software and solutions (as mentioned above) there in the industry. They offer valuable data for strategic planning, investment decisions, and competitive positioning.

Conclusion

Selecting the finest accounts payable software market is an important step toward streamlining your financial processes. Whether you're a small firm or a huge corporation, automating your AP procedures may result in higher productivity, fewer mistakes, stronger supplier relationships, and better cash flow management. Our cloud-based, end-to-end AP automation system simplifies the whole AP process, from invoice capture to payment authorization. We provide the ability to effortlessly interface with your existing systems, such as QuickBooks, NetSuite, and other ERPs.

0 notes

Text

Top Manufacturing ERP Software in India: Udyog ERP Leads the Way

You’re running a growing manufacturing business. Orders are picking up. Inventory is moving fast. But your systems are all over the place — Excel sheets for stock, WhatsApp for approvals, and some dusty old software for accounting. Things slip through the cracks. Delays pile up. You start wondering: There has to be a better way.

That’s where Udyog Best erp in india manufacturing ERP Software india steps in — the best ERP in India built specifically for the manufacturing industry.

Why Manufacturing Needs a Different ERP Approach

Manufacturing isn’t like retail or services. It has its own rhythm — raw materials coming in, machines humming, production schedules, BOMs (Bill of Materials), quality checks, dispatch timelines, and more. A standard ERP system simply doesn’t understand this flow.

That’s why Best erp in india manufacturing ERP Software india needs to be more than just software. It has to be your factory floor’s second brain — tracking every nut, bolt, and byte in real-time.

What Makes Udyog ERP the Best ERP in India?

Let’s break it down. Udyog ERP is designed with manufacturers, for manufacturers. Here’s why it stands out:

1. Real-Time Production Tracking

Know exactly what’s being produced, how much, and by when. No more guesswork.

2. Material & Inventory Control

Track every raw material batch, set reorder levels, and get smart alerts — before shortages impact production.

3. GST-Ready Invoicing & Compliance

We built our roots in tax automation, so you can count on 100% GST compliance, e-invoicing, and e-way bill generation — all built-in.

4. Role-Based Access & Custom Workflows

From shop-floor workers , everyone sees what they need. Your data stays secure and your workflow stays clean.

5. Asset Capitalization Support

For companies building large capital projects, Udyog Best erp in india manufacturing ERP Software india helps apportion costs and track project assets until capitalization.

Why Indian Manufacturers Choose Udyog ERP Again and Again

Because we speak your language — not just in software terms, but business reality. Whether you’re making precision Udyog ERP fits right in.

Explore more at Udyog ERP for Manufacturing Industry — your smart move towards operational excellence.

In Conclusion

If you’re still managing your manufacturing operations manually or with outdated systems, it’s time to rethink. The best-performing companies aren’t working harder — they’re working smarter with the right tools.

Udyog ERP is not just another system. It’s the top manufacturing ERP software in India — trusted by hundreds to streamline operations, save time, and grow faster.

Don’t let complexity hold you back. Let Udyog ERP lead the way.

0 notes

Text

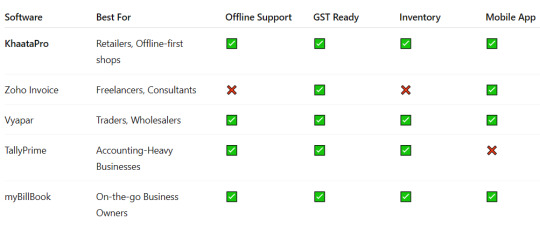

5 Best Billing Software for Small Businesses in 2025

Efficient billing is the backbone of any successful small business. Whether you run a retail shop, offer professional services, or operate a small manufacturing unit, accurate and streamlined invoicing ensures steady cash flow, organized accounts, and simplified tax filing. Thankfully, modern billing software has made it easier than ever to manage business finances.

In this blog, we explore the 5 best billing software ideal for small businesses in 2025 with a spotlight on the rising favorite, KhaataPro.

1. KhaataPro – Smart Billing, Simple Business

Khaata Pro is a powerful and easy-to-use billing software designed specifically for small and medium-sized businesses in India. Launching in 2025, Khaata Pro is poised to become a game-changer for retailers, wholesalers, and service providers who want digital billing without the tech headache.

Key Features:

Offline & Online Billing Modes

GST-Compliant Invoicing

Expense and Stock Management

Customer Credit Tracking

Multi-Language Interface (including English, Hindi, Marathi)

Mobile-Friendly Dashboard for Shopkeepers

Why Choose KhaataPro? With its user-friendly interface, regional language support, and offline functionality, KhaataPro is perfect for shop owners and local businesses that need digital solutions without constant internet access.

2. Zoho Invoice – Ideal for Service Providers

Zoho Invoice is a cloud-based billing solution tailored for freelancers, consultants, and small service-based businesses. It allows users to create professional invoices, automate payment reminders, and track time-based billing.

Highlights:

Customizable Invoice Templates

Client Portals

Online Payment Integrations

Time Tracking & Project Billing

Best For: Freelancers, consultants, and agencies looking for project-based billing with detailed time logs.

3. Vyapar – Designed for Indian Small Businesses

Vyapar is a popular GST billing software used widely in India, especially among traders and local retailers. It offers mobile and desktop support and includes features that go beyond billing, such as accounting, inventory, and order management.

Highlights:

Barcode Scanning & Inventory

Bill-wise Payment Tracking

GST Reports and Filing Assistance

Delivery Challans & Quotations

Best For: Indian shopkeepers and wholesalers who need both inventory and billing in one place.

4. TallyPrime – Trusted Accounting with Invoicing

While Tally is traditionally known for accounting, TallyPrime brings in simplified billing features with a deep focus on compliance and scalability. It suits businesses that need invoicing tied closely with accounting, inventory, and statutory reports.

Highlights:

Invoicing with Inventory Integration

GST and Multi-Tax Invoicing

Bank Reconciliation

Customizable Reports

Best For: Small to medium-sized enterprises that want billing + full-fledged accounting in one package.

5. myBillBook – Mobile-First Billing Software

myBillBook is a modern GST billing app that offers quick invoicing, real-time inventory updates, and analytics. Its mobile-first approach is great for businesses that are always on the move.

Highlights:

Create Bills in Seconds via Mobile

Digital Catalog & Stock Alerts

E-Way Bill Generation

Automatic Payment Reminders

Best For: Mobile-savvy small businesses that want flexibility and accessibility.

Final Thoughts

0 notes

Text

Why Business Owners in Puerto Rico Must Protect Their Digital Assets

In today’s business environment, digital assets are just as valuable as physical ones—sometimes more. Whether you operate a tech startup, run an e-commerce store, manage online client accounts, or simply rely on email and cloud storage to keep your business moving, your digital footprint is central to your company’s operations and legacy.

Yet many business owners in Puerto Rico overlook these assets in their estate planning. The consequences of doing so can be serious—ranging from lost revenue and access issues to legal disputes or cybersecurity threats. Protecting your digital assets is no longer optional; it’s a critical part of modern risk management and estate planning.

In this article, we’ll break down what digital assets are, why they matter for Puerto Rican entrepreneurs, and how to ensure they’re protected through smart estate planning strategies.

What Are Digital Assets?

Digital assets are any online-based or electronically stored accounts, data, or intellectual property that carry financial or operational value. For business owners, this often includes:

Business websites and domain names

E-commerce accounts (e.g., Shopify, Etsy, Amazon)

Social media profiles

Cloud storage (e.g., Google Drive, Dropbox)

Financial accounts with online-only access

Cryptocurrency or digital wallets

Customer databases or CRM platforms

SaaS accounts and licenses

Emails containing contracts or client communications

Intellectual property stored or accessed digitally

Losing access to any of these—due to incapacity or death—can disrupt operations, delay revenue, or even damage your brand’s reputation.

Why Business Owners in Puerto Rico Are at Risk

Many Puerto Rican business owners are digital-first by necessity. With remote work growing, Act 60 incentives drawing U.S.-based entrepreneurs, and the expansion of digital commerce, businesses here rely more heavily on online tools than ever before.

Despite this, most estate planning conversations still focus on physical property, bank accounts, or retirement assets. Digital assets remain a gray area—often not addressed unless specifically brought up by advisors.

The absence of local legislation explicitly covering digital estate matters in Puerto Rico only increases the risk. Without clear planning and access instructions, family members or business partners may struggle to access accounts, manage subscriptions, or even cancel payments after a business owner's passing.

This is where guidance from the top estate planning advisors in Puerto Rico becomes crucial. They understand how to legally document, secure, and distribute digital assets in compliance with evolving privacy laws and account policies.

Real Consequences of Ignoring Digital Asset Planning

Here are just a few examples of what can go wrong when digital assets are not protected:

1. Business Downtime

If only one person knows the login credentials for cloud storage, invoicing software, or customer portals, their unexpected death or incapacitation can bring the business to a standstill.

2. Revenue Loss

Unpaid orders, locked-out customer accounts, or canceled subscriptions can cost thousands in lost revenue—especially in e-commerce or subscription-based business models.

3. Legal Conflicts

Family members, employees, or partners may argue over who owns what, particularly if intellectual property or data has substantial value. Without legal documentation, these disputes can delay probate or even lead to litigation.

4. Security Threats

Abandoned digital assets become targets for cybercriminals. Unmonitored accounts can be hacked, data can be leaked, or customer information can be exposed.

How to Protect Your Digital Assets as a Business Owner

1. Create a Digital Asset Inventory

Start by documenting all your business-related digital assets. Include:

Login credentials

Account numbers

Two-factor authentication backups

Descriptions of the asset’s purpose and value

Use secure password management tools to store credentials and keep the list updated regularly.

2. Include Digital Assets in Your Estate Plan

Work with a financial or legal advisor to formally include your digital assets in your will or trust. Be specific about:

Who should access and manage each asset

What should be done with each one (e.g., transfer, close, sell)

Any restrictions or permissions (especially for confidential business data)

This process should align with the platform’s terms of service and federal privacy laws.

3. Designate a Digital Executor

A digital executor is someone you authorize to manage your digital assets after your death. This can be a business partner, spouse, or professional advisor. Granting them legal authority and clear instructions reduces friction and ensures business continuity.

4. Use Business Continuity and Succession Tools

Integrate digital asset planning into your broader business continuity strategy. If you become incapacitated, how will your team access critical systems? Set up access tiers, assign secondary administrators, and ensure that client-facing systems can continue operating.

Also Read - A Guide to Digital Assets and Estate Planning in Puerto Rico

Integrating Digital Assets Into a Long-Term Financial Strategy

Planning for digital assets doesn’t replace traditional estate planning—it enhances it. Your overall financial strategy should combine:

Physical and digital asset protection

Business succession planning

Tax-efficient estate transfer

Life insurance and income protection

Secure, legal documentation of all assets and intentions

As the digital economy continues to evolve, your financial and legal plans must evolve with it.

Final Thoughts

Digital assets are no longer niche or optional—they’re central to modern business ownership. Whether you run an e-commerce platform, a consulting firm, or a tech startup in Puerto Rico, protecting your digital presence is a critical part of protecting your legacy.

At PWR Retirement Group, we work with business owners and professionals to create complete, forward-thinking financial strategies. If you're ready to secure your future and your business with guidance from the top financial consultants in Puerto Rico, our team is here to help.

0 notes

Text

Top Reasons to Choose Accounts Receivable Outsourcing in 2025

Accounts receivable outsourcing has become a key solution for companies seeking to optimize their cash flow and streamline financial operations. Businesses can reduce overheads and enhance efficiency by shifting focus from in-house functions to professional providers. One of the biggest advantages of accounts receivable outsourcing is improved collections and faster invoicing cycles.

Companies that adopt finance and accounting outsourcing see quicker payments and better credit control. This shift also frees internal teams to concentrate on strategic activities rather than day-to-day collection issues. Outsourced finance providers use the latest tools and software to ensure accuracy, reduce errors, and improve reporting.

Moreover, organizations that outsource receivables often gain better customer relationships, as third-party professionals handle communications more diplomatically and consistently. When combined with accounts payable outsourcing, the business gains a complete financial workflow improvement.

If your goal is to scale and maintain accuracy without overburdening your internal resources, then accounts receivable outsourcing is a smart step toward sustainable financial management.

0 notes

Text

Top 10 Corporate Cards for Indian Businesses in 2025: Unlock Exclusive Perks & Financial Control

In the fast-paced world of Indian business, managing company expenses efficiently has become more critical than ever. Whether you're a startup scaling rapidly or a large enterprise optimizing your spend, corporate credit cards can unlock powerful advantages—from real-time tracking to exclusive rewards and streamlined reimbursements. In 2025, corporate cards have evolved into strategic financial tools, especially when paired with smart solutions like travel booking software and travel management software.

Here’s our handpicked list of the Top 10 Corporate Cards for Indian Businesses in 2025 that offer unparalleled control, rewards, and automation.

1. SBI Corporate Credit Card

Why it stands out: Ideal for established businesses, the SBI Corporate Card offers detailed MIS reports, global acceptance, and custom spending limits.

Perk: Integration with travel management software enables seamless travel expense tracking and approval flows.

2. HDFC Corporate Platinum Card

Why it stands out: HDFC’s card is popular for its high credit limits and employee spend monitoring features.

Perk: Get exclusive travel rewards and pair it with travel booking software for effortless business trip planning.

3. ICICI Bank Business Advantage Black Card

Why it stands out: It provides cashback on every spend and tools to control employee usage.

Perk: Works great with travel management software to streamline reimbursements.

4. Axis Bank Business Credit Card

Why it stands out: Axis Bank offers customized solutions for SMEs with detailed spend insights.

Perk: Automate bookings and approvals using your preferred travel booking software.

5. American Express Business Gold Card

Why it stands out: A prestigious card offering rewards tailored for business purchases and global assistance.

Perk: Excellent for international business travel—sync with travel management software to manage itineraries and expenses.

6. RazorpayX Corporate Cards

Why it stands out: Built for digital-first companies, RazorpayX cards offer real-time expense tracking and virtual card options.

Perk: Integrates with accounting systems and travel booking software for complete financial visibility.

7. Karbon Corporate Card

Why it stands out: Startup-friendly, with no personal guarantees and instant issuance of virtual cards.

Perk: Can be easily linked with travel management software to handle multi-employee travel needs.

8. EnKash Corporate Card

Why it stands out: Offers flexible repayment, employee-wise limits, and AI-powered spend analytics.

Perk: Ideal for automating travel-related expenses via travel booking software.

9. Volopay Corporate Card

Why it stands out: Designed for Indian startups and SMEs, it provides detailed expense tracking and seamless foreign currency transactions.

Perk: Syncs with travel management software to manage team travel budgets efficiently.

10. Happay Expense Card

Why it stands out: Known for powerful expense management tools and analytics.

Perk: Best-in-class integration with travel booking software to reduce manual processing of travel invoices.

Final Thoughts

In 2025, the best corporate cards do more than just facilitate payments—they act as enablers of smart business operations. When used alongside robust travel booking software and travel management software, these cards provide financial control, reduce admin overhead, and unlock business growth through exclusive perks.

Whether your priority is travel rewards, detailed expense insights, or integration with digital tools, choosing the right corporate card.

0 notes